4 Rewards and Transaction Fees

Möbby has a novel reward mechanism that incentivizes participation and availability. In a nutshell, if a party participates in the Möbby consensus as a validator or proposer, they receive a fair cut of rewards (aka treasury incentives)—as the system evolves, transaction fees will also be added to compensate servers. Novel in the design of the Möbby reward and fee distribution mechanism is that part of the reward that a server receives is distributed to the users that contributed to this node’s reputation, where each such user is compensated analogously to the role it played in the node’s reputation. In our technical paper which is to be released soon, we provide such a reward mechanism that incentivizes users to report their true belief of each node’s trustworthiness. This is related to Property 1 of the reputation monetization strategy discussed at the beginning of this analysis.

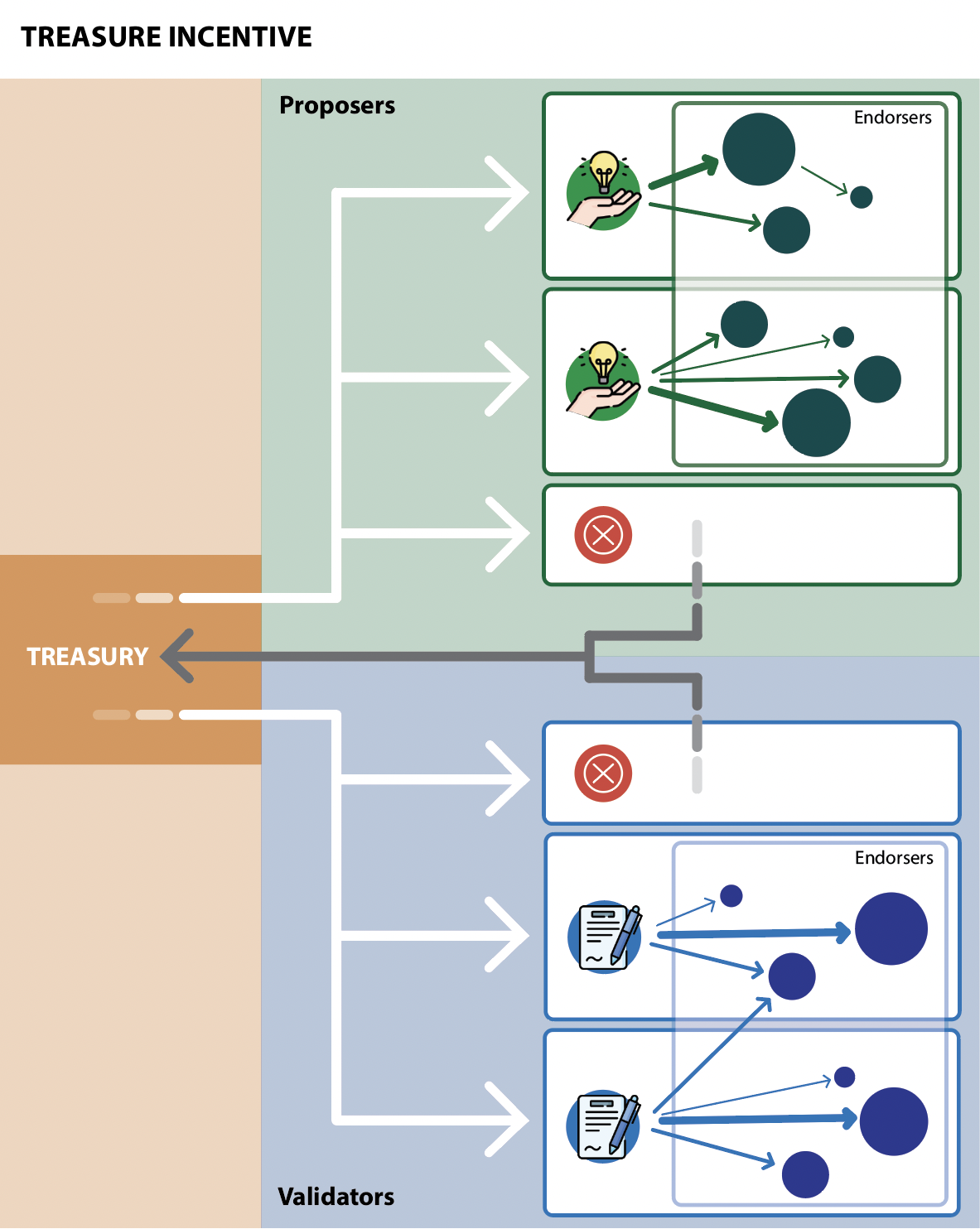

4.1 Token (Treasury + Fees) Rewards

When a block B is finalized in the blockchain, parties in committees  BC and

BC and  BA that participated in its creation,

as well as their endorsers, are rewarded from two sources: block rewards (aka treasury incentives) and the

transaction fees (to be added at a later stage of system deployment). The treasury

incentives come from the

Treasury, which is a reserve of Möbby tokens set aside and scheduled to be injected to the Möbby

economy as new blocks are generated. The number of tokens in the treasury incentives may differ from

epoch to epoch. However, within an epoch, every validator (resp. proposer) that participated in the

block creation is offered a fixed number of tokens for their contribution, regardless of the number of

validators/proposers in that round. Transaction fees, once they are introduced, will be paid by transaction senders,

to incentivize its inclusion into the chain. Similar to major blockchains (e.g, Bitcoin, Ethereum, etc) each

transaction sender can decide on how much or little transaction fee they would like to pay, for maximum

flexibility.

BA that participated in its creation,

as well as their endorsers, are rewarded from two sources: block rewards (aka treasury incentives) and the

transaction fees (to be added at a later stage of system deployment). The treasury

incentives come from the

Treasury, which is a reserve of Möbby tokens set aside and scheduled to be injected to the Möbby

economy as new blocks are generated. The number of tokens in the treasury incentives may differ from

epoch to epoch. However, within an epoch, every validator (resp. proposer) that participated in the

block creation is offered a fixed number of tokens for their contribution, regardless of the number of

validators/proposers in that round. Transaction fees, once they are introduced, will be paid by transaction senders,

to incentivize its inclusion into the chain. Similar to major blockchains (e.g, Bitcoin, Ethereum, etc) each

transaction sender can decide on how much or little transaction fee they would like to pay, for maximum

flexibility.

Treasury Incentives / Block Rewards

In this section, we specify the basic algorithm distributing block rewards and treasury when a block is created. We also describe further additions to the basic algorithm.

Treasury / Block Rewards Distribution

BA and

BA and  BC, the block B, and the endorsement graph E, and

outputs reward such that reward[P] is the total treasury incentives distributed to party P from the creation of

block B. A fixed number of tokens vbreward as treasury incentive is offered to each validator, and another fixed

number pbreward is offered to each proposer. If a validator (resp. proposer) participates

correctly in the creation of

the block—for example, signs the block as a validator—then the validator (resp. proposer) receives the

offered

treasury incentives. In other words, the amount of reward a committee member receives only depends on their

action (whether they participate correctly or not). If a validator or proposer has endorsers, then the rewards they

receive will be shared automatically with those endorsers by a fair distribution function sharerewards. If some

committee member does not participate, then their fraction of the treasury incentives is returned to the

Treasury.

BC, the block B, and the endorsement graph E, and

outputs reward such that reward[P] is the total treasury incentives distributed to party P from the creation of

block B. A fixed number of tokens vbreward as treasury incentive is offered to each validator, and another fixed

number pbreward is offered to each proposer. If a validator (resp. proposer) participates

correctly in the creation of

the block—for example, signs the block as a validator—then the validator (resp. proposer) receives the

offered

treasury incentives. In other words, the amount of reward a committee member receives only depends on their

action (whether they participate correctly or not). If a validator or proposer has endorsers, then the rewards they

receive will be shared automatically with those endorsers by a fair distribution function sharerewards. If some

committee member does not participate, then their fraction of the treasury incentives is returned to the

Treasury.Timing of rewards: Rewards on Block i are posted as coinbase transactions (token minting) at Block i + k for a

constant parameter k (In the above figure, k = 1 and the k - 1 blocks following Block i are gathering signatures by

the  BA and

BA and  BC committees corresponding to Block i). Rewards are issued in a time-lock manner and can only be

spent after ~ 3 days (129,600 blocks). This will ensure that at least a whole epoch has

passed on the

secondary chain and therefore, the relevant block has had a chance to be confirmed (finalized) also

there.

BC committees corresponding to Block i). Rewards are issued in a time-lock manner and can only be

spent after ~ 3 days (129,600 blocks). This will ensure that at least a whole epoch has

passed on the

secondary chain and therefore, the relevant block has had a chance to be confirmed (finalized) also

there.

|

|

|

|

reward←BlockDist(

BC BC  BA

,B,E,vbreward,pbreward): BA

,B,E,vbreward,pbreward):

|

|

|

|

|

Further Additions to Reward Distribution A number of novel additions to the above reward distribution mechanism will be included to boost participation and trustworthiness. In particular:

- A number of new blockchain systems offer passive reward as a form of dividends to incentivize adoption. By design Möbby does not have an exogenous mechanism to horizontally reward parties in the system. However, the same effect (in terms of incentives) as passive dividends is achieved in Möbby by allowing parties to receive dividends through their ability to endorse Möbby servers. In particular, any new account in the system is randomly assigned a small number of servers to endorse. Using the redistribution mechanisms for rewards discussed above, this ensures that each account receives part of the rewards whenever its (automatically assigned) server is selected in CBA. Importantly, by the users getting informed about the servers reputation and (truthfully) reporting their opinion, they can increase (in fact, maximize) their reward using the Möbby endorsement mechanism.

- Parties proven to have participated incorrectly or maliciously, permanently lose their cut of treasury incentives/transaction fees—as well as their reputation, which makes them unlikely to be selected as a validator/proposer in the future.

Token Infusion as Rewards

An active debate in the blockchain literature is whether systems should be inflationary or not. In fact,

even the term inflationary is overloaded and has received two interpretations: one is that new (non-anticipated) coins are minted as

needed—this is the classical notion of inflationary economies in which central banks might print money; the second one is that there

is a fixed amount of tokens to be minted and they are gradually released in the economy as treasury incentives (e.g., blockrewards,

governance tokens, etc.), research and/or development grants, employee incentives etc. To avoid confusion, we will use the terms infusion

and infusionary (rather than inflation and inflationary) to refer to the latter model where a max supply is fixed at the beginning.

This is the model adopted by Möbby.

Although a rigorous and robust distribution plan has been laid out by out team, the Möbby team recognizes that the question of whether or not,

and when inflation should be included in the lifetime of the system is an open question that depends on the (still underexplored)

dynamics of the emerging crypto market. Our strategy above is designed so that we are guaranteed to not need to address this issue for

the next 7-10 years. In addition, transaction fees which will be added once the system transitions from federated to decentralized and

will be informed by a governance mechanism are expected to further increase the above non-inflationary period by taking over the role of

treasury incentives. We believe that this is a sufficiently long maturity period for the crypto market to test and converge to best practices

and evaluate the effects of each strategy. Should our open-ended non-inflationary period appear to fade out, i.e., if reserves fade out

and fees do not take over the incentives, the system will employ a governance mechanism (to be deployed by then) to decide on whether creation

of new Möbby is desired by the vast majority of its users.